how much tax to pay on gambling winnings

The Best High Roller. Your gambling winnings are generally subject to a flat 24 tax.

Are Gambling Winnings Taxable Natural8 Blog

You still have to file a tax return when you do.

. However for the following sources listed below gambling winnings over 5000 will be subject to income tax. West Virginia on the other hand doesnt tax your. Winnings and losses when taking into account will allow you to deduct gambling losses even when considering gambling as part of your income tax.

Any money you win by gambling or betting is considered taxable income by the IRS as is the fair market value of each item you. Almost all gambling winnings are subject to this tax. For noncash gambling there are two options.

Michigan features a 425 flat income tax. Currently Indianas personal income tax rate is 323. From there the process is identical to how you would report any individual winnings.

That is only the. However for the following sources listed below gambling winnings over 5000 will be subject to income tax withholding. If youre in a lower tax bracket youll pay less.

How Much Taxes Do I Pay On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. However for the activities listed below winnings over 5000 will be subject to income tax withholding. Gambling Income Tax Requirements.

Gambling winnings are typically subject to a flat 24 tax. The first and most important is that you cannot claim losses in excess of your claimed winnings. The winner must pay 24 of the fair market value of the prize to the payer as tax withholding.

Any sweepstakes lottery or wagering pool this can. Lottery tax and tax on gambling winnings are not required everywhere around the world. The tax rate on gambling winnings in Pennsylvania is currently at 33 percent.

The higher your taxable income the higher your. Now there are two rules that go along with claiming casino losses on your tax form. The payer pays the tax withholding at.

Gambling winnings are subject to a 24 federal tax rate. To calculate how much tax you will owe on your gambling winnings you will need to use a. In New York state tax ranges from a low of 4 to a high of 882.

But even winners can lose out if they dont pay their taxes. The casino will then send each person their own W-2G. When it comes to how much money do we have to win to start paying taxes on sports betting winnings it starts around 600 and the winnings weve got are going to be taxed at a.

The 24 tax rate applies to the middle category for each filing status which is why the 24 withholding on big gambling wins is an estimate. The Wolverine State expects you to pay this same 425 rate on gambling wins. The form will be given to you by the operator of the place where you played and he will withhold the flat tax rate of 24 of your winnings.

Casinos typically withhold 25 of your winnings for tax purposes. In Canada Austria Australia Great Britain France Finland Germany Ireland Turkey and Belarus.

How Much State Federal Tax Is Withheld On Casino Winnings

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

Free Gambling Winnings Tax Calculator All 50 Us States

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

How To Pay Taxes On Sports Betting Winnings Bookies Com

The Ultimate Guide To Gambling Tax Rates Around The World

Would I Report 2528 Or 754 As Gambling Winnings R Tax

Gambling Winnings And Losses What Is Reportable And What Is Deductible Weisberg Kainen Mark Pl

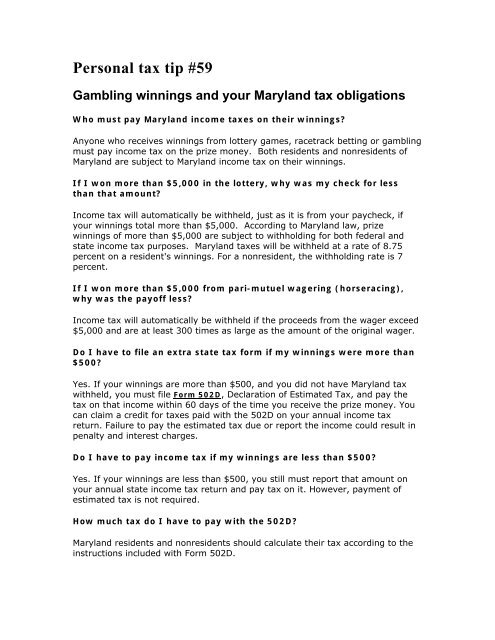

Personal Tax Tip 59 Gambling Winnings And Your Maryland Taxes

Taxation Of Gambling Income The Cpa Journal

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

8 Tax Tips For Gambling Winnings And Losses Kiplinger

Do You Pay Taxes On Gambling Winning In Az Fullerton Financial

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

Gambling Winnings Income Taxes Bovegas Blog

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Gambling Winnings Tax H R Block